There was a feeling of déjà vu to the third quarter. Like the first quarter, the pandemic surprisingly surged and extreme weather swept through the country, taking the wind out of the quarter’s recovery sails. But business spending and a rebounding commercial sector pushed the economy in the right direction.

The General Economy

Projections in July assumed another consumer-led service sector booming quarter, but then the Delta variant spread through communities, disrupting activity. Growth in personal consumption expenditures (PCE), which was expected to be over 2 percent, was reduced to 0.7 percent. Sales at food and drink establishments stalled. The unemployment rate has declined each month this quarter, but the gains made in restaurant jobs flattened. The mismatch persisted between the abundance of job openings and the desire and ability of people to work. This situation was exacerbated by “The Great Resignation.” The number of employees who voluntarily left their jobs in July was the second highest month on record.

Sluggish consumer spending tempered Gross Domestic Product (GDP) growth. Droughts, wildfires and hurricanes further deterred buying, building and deliveries. Fannie Mae forecasted that the economy would expand at an annualized rate of 3.7 percent, significantly less than the first two quarters of 2021. One upside of the cooling economy is the moderation in inflation expectations. The month-to-month Consumer Price Index (CPI) shrank to a less concerning 0.3 percent in August. While the Federal Reserve increased its inflation projection for the year, it maintained that inflation is temporary and made no changes to its interest rate.

The business sector buoyed the recovery. Industrial production pushed past its pre-pandemic level in July. Durable goods orders grew for the fourth straight month in August, despite sporadic car production. Companies had low inventories, robust demand and a backlog of orders. Larger businesses enjoyed a favorable financial footing to support investment, including untapped credit lines, improved stock values and significant cash reserves. Component shortages and delayed deliveries held back a greater business expansion.

The Real Estate Sector

Residential

The single-family market cooled but was still healthy. Although house completions and listings were up, home prices continued their momentous climb. Expectations for existing home sales were lowered as the quarter progressed and settled slightly below the 6 million units annual pace. But favorable interest rates and sustained demand boosted purchase originations and August pending home sales. According to the National Association of REALTORS® (NAR) and the National Association of Home Builders, days on market, housing inventory and builder sentiment steadied during the quarter.

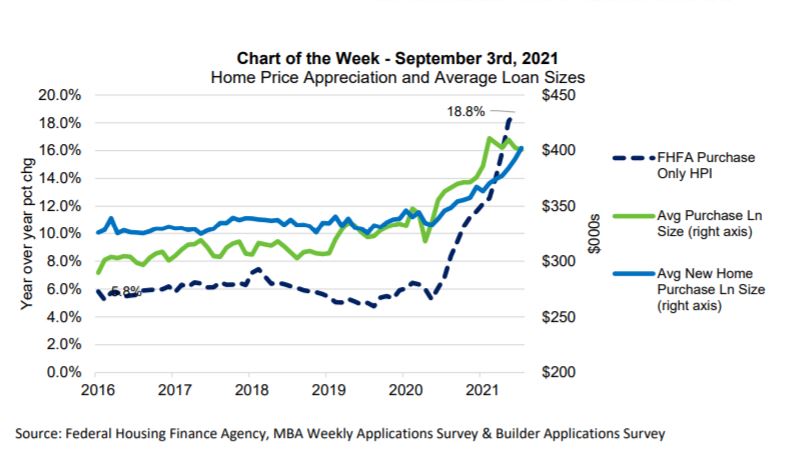

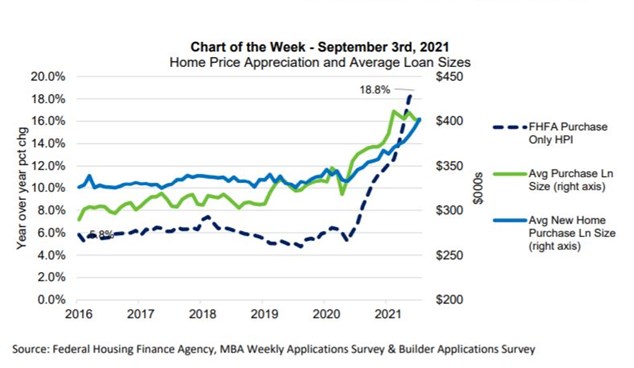

Homebuilders faced overwhelming backlogs created by supply constraints. Thus, many were hesitant to take new orders. Single-family housing starts were down for most of the quarter. A divergence also emerged in the high-end and entry-level markets. Larger, more expensive houses were the focus of new construction, and the additional inventory eased the ultra-competitive environment. Loan sizes crept up, as depicted in the Mortgage Bankers Association (MBA) chart below.

This trend meant that the unsatisfied demand for entry level homes endured. NAR reported that first-time home buyers accounted for 29 percent of sales in August, down from 33 percent a year ago.

Commercial

Commercial real estate (CRE) may be on the cusp of recovery. Commercial activity returned to its pre-pandemic levels, according to Real Capital Analytics (RCA). Rents were supported by first-time home buyers staying in their apartments longer as they searched for a home. Industrial property demand remained strong, thanks to e-commerce. Office pricing, particularly in suburban areas and second-tier cities, improved. However, this sector’s situation remained precarious with companies delaying return-to-work or embracing a hybrid work model. Eighteen months into the pandemic, the big wave of distressed assets in the at-risk retail and hotel sectors had not appeared.

Consequently, opportunistic investors are pursuing places to put their money. Alternative assets, particularly life sciences and data centers, have attracted their attention. Propelled into the spotlight because of COVID-19 vaccine funding, the life sciences sector garnered a record $38 billion in venture capital in the first half of 2021, according to JLL’s 2021 Life Science Real Estate Outlook. E-commerce’s exploding demand for computing power and storage is driving the growth of data centers. Both sectors’ rapid expansion will impact land use. Life sciences lab space and headquarters, with their preferred placement in urban areas and college towns, may offset the office flight in cities like Boston. Data centers and life sciences production facilities have large footprints, and can be placed farther afield, or use converted retired malls and office parks. Due to their electricity draw, more data centers are spurring development of alternative energy sites.

A Glance Forward

Future unknowns are making it difficult for forecasters, from the intensity of the flu season to the next shortage of critical materials. But some things are certain. One, the holiday season is just around the corner. Consequently, a resurgence in consumer spending, especially on goods, is expected. Rising to meet demand and restock inventories, businesses will be the primary driver of the fourth quarter. Fannie Mae projects that business investment will shoot up to an annual growth rate of 8.5 percent. It also expects GDP to advance 5.3 percent for this quarter and 5.4 percent for the entirety of 2021. The Federal Reserve is more optimistic, projecting 2021 growth at 5.9 percent. In a recent press conference, Federal Reserve Chair Jerome Powell said the organization may begin tapering asset purchases as soon as November.

The second certainty is the expiration in September of impactful pandemic support programs, namely enhanced unemployment benefits, the moratoriums on evictions and foreclosures, and CARES Act forbearance plans. With kids back in school and the Delta surge waning, labor may become more plentiful. Unemployment may drop at least another 0.5 percent. Despite the end of mortgage assistance, few are predicting a housing crisis. Forbearance rates fell below a very manageable 3 percent in mid-September. Considerable resources are still available to distressed borrowers and a vast majority of those in forbearance programs have at least 10 percent in home equity. An uptick in housing inventory from delinquent borrowers putting their houses up for sale is the likely scenario. Combined with the expected clearing of the home construction backlog, buyers should have more choices. The MBA forecasts that existing home sales should again climb above 6 million units annualized rate and single-family starts are expected to rebound in the fourth quarter by 4.9 percent. Mix in some holiday cheer, and the prospect for continued economic recovery in 2022 looks merry and bright.