The General Economy

In the third quarter of this year, the economy shrugged off talk of a recession and returned to positive territory, thanks to the consumers’ staying power. Annualized Gross Domestic Product (GDP) is projected to have grown 1.3 percent after falling in the first and second quarters. Although residential investment plummeted as the housing market cooled, business spending bounced back slightly and companies worked through their overstocked inventory*. Consumers contributed about 1.5 percent to economic growth, more than making up for some sagging sectors. Real earnings for workers crept up in August, and the employment situation was steadily supportive.

Inflation, as measured by the Consumer Price Index (CPI), may have peaked in June, but its downward path was uneven and primarily propelled by falling gasoline prices. Advancing costs of a broad set of items, including shelter, kept the CPI at a burdensome annualized rate of 8.3 percent in August.

Inflation’s persistent shadow also influenced changes in consumption patterns. Earlier in the year, people were absorbing higher prices even as they enjoyed a reopened economy. This past quarter, revenge spending was still evident. Travel returned, with Labor Day weekend airport throughput rebounding to pre-pandemic levels. People relished eating out, back-to-school shopping and summer entertainment. But with a potential recession in 2023 looming, consumers began looking for ways to reduce their costs. Shoppers passed on big ticket “nesting” purchases that drove a lot of retail growth earlier in the pandemic, such as furniture and appliances. Spending also shifted away from discretionary goods to necessities, and from high-end retailers and name-brand groceries to down-market options.

The Real Estate Sector

Residential

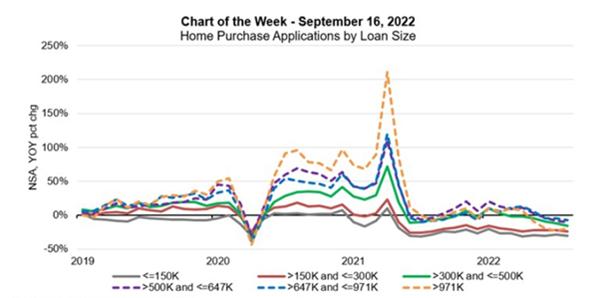

Despite summer being a traditionally strong season for buying and building houses, the housing market struggled against surging interest rates. After dramatic drops in the second quarter, existing and new single family home sales are projected to have moderately declined again, at 6.4 and 4.2 percent respectively. Builders, nervous about weakening demand, reduced their activity. Single-family starts are projected to have fallen below an annualized rate of one million units for the first time in two years. The unit volume of purchase mortgage originations correspondingly fell during the quarter by almost 15 percent. A wobbly stock market eroded wealth on the top end of the market, while dwindling affordability undermined the lower and middle tiers.

Source: MBA Weekly Applications Survey

To combat inflation, the Federal Reserve (The Fed) upped interest rates in both July and September by 75 basis points. The 30-year fixed mortgage rate responded, jumping to 6.7 percent by the end of September, the highest point in 15 years.

With rates up, hope for a reversal in the housing market relies on prices normalizing. Fannie Mae projects that their Home Price Index’s rate of increase slowed by 2 percent for the quarter, while the Mortgage Bankers Association (MBA) indicated the FHFA US House Price Index weakened by 5.3 percent. Countervailing forces are at work, accounting for the variability in anticipated prices. Home prices are a bit “sticky” – it takes time to react to new market conditions. Ballooning rates are a disincentive to sellers, who have existing, relatively low-rate mortgages. Over 80 percent of mortgages have a rate at least 1 percent below the current 30-year rate, according to Fannie Mae. Buyers may be standing on the sidelines as rates and home prices are expected to moderate next year.

There are some downward pressures on home prices. According to the National Association of REALTORS®, the months’ supply of homes for sale has doubled since January. Falling lumber costs** and reduced foot traffic are motivating builders to reduce prices and use incentives to prod sales, per the National Association of Home Builders (NAHB). DS News reported that the frenzy of multiple offers has abated, and the number of homes selling for above asking price has fallen.

Commercial

Commercial Real Estate (CRE) overall performed well, but compared to the banner year of 2021, deal volumes and prices were down, according to MSCI. Additionally, the Federal Deposit Insurance Corporation (FDIC) released guidelines for the upcoming bank stress tests and included a section on concerns over commercial real estate. But delinquencies on commercial loans were still very low, so it was likely the FDIC wanted to be ahead of any problems. Moreover, the fundamentals for most CRE sectors were solid. Both leisure and business travel returned. Retail properties saw more shop openings than closings nationally.

While there was some lightening of demand in industrial logistics, due to the normalization of e-commerce trends, vacancy rates were at an all-time low and manufacturing space resurged. Apartment demand remained high as aspiring homebuyers were priced out of the single-family housing market. The office sector continued as a concern but its future may be clearer soon. Labor Day was the unofficial return to the office day, so property managers may now know headcounts and space requirements for their new normal.

A Glance Forward

Economic growth for the fourth quarter hinges on inflation’s path. If inflation is tamed to about 7.2 percent for the quarter as expected, it will boost consumer confidence. Fannie Mae forecasts a small advancement in GDP of 0.7 percent.

The Fed will likely raise its rate at least another 1 percent in the fourth quarter, both to support the fight on inflation and to “align” supply and demand in the housing and job markets. Unemployment should end the year almost in the same place as it started. But looking beyond this headline indicator, some softening in the labor market is evident and it may further weaken. Job openings are slightly down and the labor participation rate*** remained steadfastly above 62 percent. According to The Fed’s summary of economic activity, salary expectations have moderated and there is improved worker retention.

The residential housing market correction will extend. Fannie Mae believes the severest drops in housing starts and sales may be behind us for the year. But Fannie Mae and the MBA differ on whether the market has bottomed out; it all depends on the tempo of price declines. The MBA shows the Home Price Index tempering to single digits, while Fannie Mae does not. The fourth quarter will feel quite a bit like the third, with the Fed’s intentionally painful course bearing some fruit.

* U.S. Census Bureau, Total Business Inventories [TOTBUSMPCIMSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TOTBUSMPCIMSA, October 5, 2022.

** U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Lumber and Wood Products: Softwood Lumber [WPU0811], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WPU0811, October 7, 2022.

*** U.S. Bureau of Labor Statistics, Labor Force Participation Rate [CIVPART], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CIVPART, October 4, 2022.