Buying a home is a team effort. There are numerous steps that require a thorough understanding of detailed information. Even after doing extensive research, it will never compare to the experience and knowledge of an industry expert. That’s why it’s important to build a knowledgeable team of professionals. To aid you in this effort, we’ve compiled a list of players to engage during the homebuying process.

Real Estate Agent

Think of a real estate agent as the “quarterback” who gets the ball rolling and guides you through each step of the homebuying process until you receive the keys to your dream home. Here are four big benefits to using a real estate agent:

1. Connect you with a reputable mortgage loan officer: A real estate agent’s first step is generally to connect you with a reputable loan officer that will review your income and finances to issue a preapproval or prequalification letter from mortgage lenders. This type of letter outlines the maximum loan amount you can receive to finance your home, the loan type, the estimated mortgage rate and loan terms.

2. Act as a house-hunting guide: A real estate agent will take your list of must-haves and dealbreakers, and use the Multiple Listing Service (MLS) and their access to pocket listings to create a catalog of homes for you to view. To help narrow down your search, they can provide information about public transportation and nearby amenities, such as shopping centers and recreational services. They can also refer you to reputable third-party resources regarding crime rates and school scores.

3. Conduct comprehensive analysis of potential homes and the housing market: When you’ve found the perfect home, a real estate agent can readily conduct a Comparative Market Analysis (CMA). A CMA is an unbiased tool that considers variables like the square footage of the home, the number of bedrooms and bathrooms, and the property’s condition and location to determine the value of the home compared to others nearby. A CMA, along with a review of current market conditions, is generally used to help determine an offer to present to the seller.

4. Be your skilled negotiator and industry expert: Your real estate agent will work directly with the listing agent to submit an offer on your behalf, negotiating any counter offers, seller concessions or contingencies that need to be addressed. Once your offer is accepted, a purchase agreement will be created to outline all the terms and conditions of the transaction.

Real estate agents are skilled negotiators who also possess knowledge of federal and state-specific real estate legislation in the state where they are licensed. They will carefully review the purchase agreement with your best interests in mind, keeping you informed of changing regulations that may affect you. For example, effective August 2024, if a buyer’s agent participates in the MLS, they will be required to sign a brokerage service agreement outlining the terms of service, value offered and associated charges before they conduct house tours. Compensation would continue to remain subject to negotiation between all parties, but only off-MLS. In some states, like Washington for instance, similar representation requirements are already in place.

Mortgage Lender

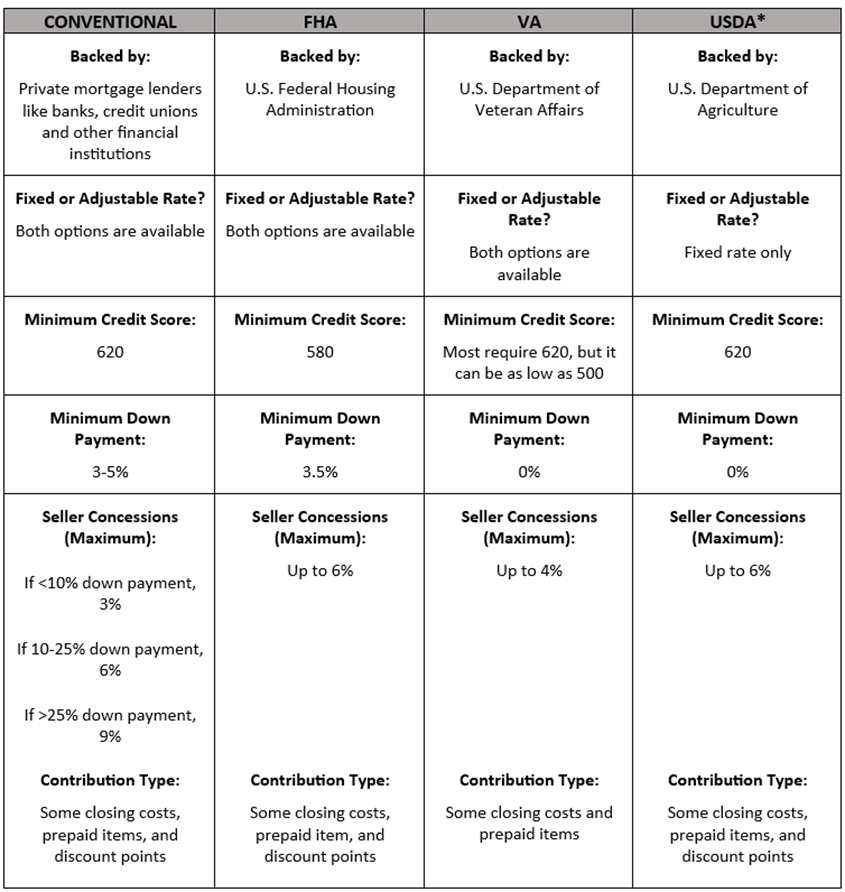

Most homeowners, especially first-timers, require a mortgage loan to finance their home. A mortgage lender is a financial institution that offers and underwrites home loans. Not all mortgage lenders or mortgage loans are the same, so it’s important to ask questions and compare requirements and details. For example, consider whether the mortgage lender is offering a fixed rate or adjustable rate mortgage, what the minimum credit score and down payment are, and what limitations are placed on seller concessions. These criteria will help you understand eligibility requirements, additional expenses associated with the loan, and how the seller can help contribute to your closing costs, buyer’s agent commissions or other items.

There are four main types of mortgage loans: conventional, FHA, VA and USDA. Although the specifics of each transaction dictate exact loan terms, we’ve created a chart that summarizes some of the main requirements and seller concession maximum contributions for each type of loan when purchasing a primary home. Keep in mind that the percentages listed below are based on the purchase price of the home.

*Some state and county maximum loan amounts may apply.

Navigating mortgage loans can be complicated. To help ease the process, the Consumer Financial Protection Bureau (CFPB) created resources to inform and empower consumers to make informed decisions. Click here to take advantage of these valuable resources.

Closing Agent

Purchasing a home involves the transfer of large sums of money and paperwork. The closing process was developed to ensure that these tasks are performed in compliance with the latest security and privacy standards. During this process, a closing agent acts as a neutral third party to communicate between all parties, assemble and process paperwork, and disburse money in accordance with the terms and conditions of the purchase agreement and written closing instructions. Depending on what state you live in, the closing agent could be a title company, an escrow company or an attorney.

Real estate agents work with closing agents regularly and can recommend them to you. However, the buyer has a right to choose. When deciding on the right closing agent to work with, look for one that is well-respected, has experience and is known for effectively communicating throughout the entire closing process.

Title Insurer

When you purchase a home, you receive title to the property, which shows your legal right to own it. Title insurance protects homeowners from prior title defects that remain undisclosed even after the most meticulous title search. This is what makes title insurance so important!

As a homeowner, purchasing an owner’s title policy provides peace of mind that your title insurer will stand behind you if a covered title issue, such as a tax lien, forged signature or clerical error, is discovered after the home is purchased. For a one-time fee, an owner’s title policy protects your property rights for as long as you and your heirs own the home. The mortgage lender is shielded from financial loss for covered risks by a lender's policy, which is normally paid for by the homeowner. Lenders require title insurance because they understand how important it is to safeguard their investment.

As a homebuyer, you have a right to choose your title insurer. When making the choice, consider the financial stability and reputation of the company. Look for a title insurer that is positioned to back policies and claims for the long run, and makes data privacy and security a top priority.

Assembling a dream team of knowledgeable, passionate professionals is essential to a rewarding homebuying journey. It enables a smoother transaction, reduces risks and enhances your overall experience. Choose wisely, and let your team help you achieve your dreams of homeownership! To make Old Republic Title a part of your team, contact an Old Republic Title representative today.