The U.S. continues to be a popular place for foreign investment in real estate. According to a 2023 study conducted by the National Association of REALTORS® (NAR), foreign buyers purchased over $50 billion worth of U.S. homes from April 2022 through March 2023. Eventually, foreign property owners will become sellers, and when that time comes, the transaction may be subject to income taxes and withholdings under the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA).

FIRPTA is a complex tax law that, if ignored, can result in significant financial penalties. If you find yourself purchasing a home from a foreign seller, it’s important to consult with a tax professional to ensure you’re in compliance with the law. In this blog, we’ll explore a basic overview of the FIRPTA withholding requirements, general exceptions and limitations, special rules and the role of the closer during FIRPTA transactions.

What is FIRPTA and How Does It Work?

FIRPTA was enacted to ensure that foreign sellers who realize capital gains from disposition of United States (U.S.) real property interests are held accountable for their tax obligations. FIRPTA defines a foreign person as a nonresident alien individual or foreign corporation that has not made an election to be treated as a domestic corporation, foreign partnership, foreign trust, or foreign estate. A foreign person does not include a resident alien individual.

When a foreign person disposes real property interests, FIRPTA requires fifteen percent (15%) on the amount realized to be withheld as a “deposit” per the Internal Revenue Service (IRS), unless an exception applies. Although the withholding is subject to the seller/transferor, in most cases, the withholding agent is the buyer/transferee. Therefore, the buyer/transferee is generally required to report to the IRS the amount withheld within 20 days of the closing by filing the applicable tax forms.

The withholding amount is applied to the total tax due by the foreign seller/transferor and is not the tax itself. The IRS calculates the full tax due once the seller/transferor files a U.S. tax return. If the buyer/transferee fails to withhold and the foreign seller/transferor fails to satisfy its U.S. tax liability, both the buyer/transferee and the seller/transferor can be held liable for the tax, along with interest and penalties.

Exceptions to FIRPTA Withholding

There are some exceptions that eliminate or reduce the FIRPTA withholding requirement for individuals. The most common exceptions include, but are not limited to, the following:

• Property Value and Use. If the buyer/transferee purchases a property that is less than $300,000, the FIRPTA withholding is not required if the buyer/transferee, or a member of the buyer/transferee’s family, resides in the property for at least 50 percent of the time for the first two years following the date of the transfer of the property (the days the property is vacant are not included). It is required that the buyer/transferee signs an affidavit attesting to the use of the property.

• Non-Foreign Status. The seller/transferor provides a certification stating, under penalty of perjury, that they are not a foreign person. The certification must include the seller/transferor’s name, U.S. taxpayer identification number and home address (or office address, in the case of an entity).

• Withholding Certificate. Under the circumstances listed below, the buyer/transferee or the seller/transferor can reduce or eliminate the FIRPTA withholding by submitting an application to the IRS for a withholding certificate. If the seller/transferor applies for a certificate, notification must be provided to the buyer/transferee in writing on the day of, or prior to, the transfer of the property. Once an application is submitted, the IRS generally processes the application within 90 days of receipt.

The IRS may issue a withholding certificate under the following circumstances:

- The withholding is more than the seller/transferor’s maximum tax liability, or reducing the withholding does not impede the ability to collect the tax. For instance, the foreign seller/transferor receives no gains because the property was sold at a price lower than originally purchased;

- The seller/transferor is exempt from U.S. tax on the gain realized from the transfer of the property, such as a qualifying 1031 exchange; or

- There is an agreement for payment of the tax that provides security for the tax liability by either the buyer/transferee or the seller/transferor.

For more information about FIRPTA exceptions, click here.

Limitations on the Amount Required to be Withheld

Some transactions may qualify for a reduced withholding rate equal to ten percent (10%). To qualify, all of the following criteria must apply:

- Buyer/transferee must be individuals and use the property as a residence;

- The amount realized does not exceed $1,000,000; and

- The $300,000 exception does not apply.

The withholding can also be reduced when the property is owned jointly by a foreign and nonforeign seller/transferor. The amount subject to withholding is determined by allocating the amount realized from the disposition based upon the capital contribution of each party. If the sellers/transferors are a married couple, each seller/transferor will be deemed to have contributed 50 percent.

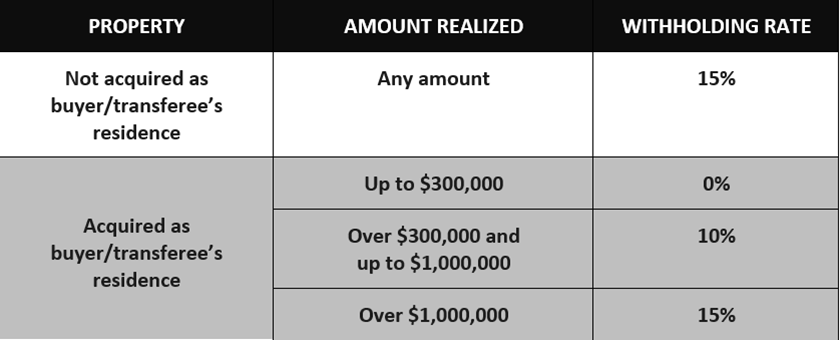

Rates of Withholding

FIRPTA withholding rates (for individuals) are based upon the buyer/transferee’s intended use of the property and the total amount realized from the disposition of the foreign seller/transferor’s U.S. real property interests. Given the list of FIRPTA exceptions and limitations on the amounts required to be withheld, the applicable withholding rates are calculated as follows:

Transactions with Special Rules

Some transactions, including the ones listed below, have special rules regarding FIRPTA requirements. It’s imperative to consult with a tax professional to make sure you understand them.

• Seller/transferor is a domestic partnership, domestic trust or domestic estate: If any partner or beneficiary of the partnership, trust or estate is a foreign person, a withholding as much as 35 percent may be required. FIRPTA places the burden of the withholding on the partner, fiduciary or other representative of the domestic entity.

• Purchaser/transferee is a government body: No withholding is required when the buyer/transferee is the United States government, a state or possession of the United States, a political subdivision thereof, or the District of Columbia.

• Foreclosures: If the borrower being foreclosed upon is a foreign person, the transaction may still be subject to the FIRPTA withholding. However, special rules allow for an “alternative amount” that is less than the standard withholding. The amount is determined by the court or trustee and is generally calculated from any surplus of proceeds from the foreclosure sale after the foreclosing loan has been paid in full.

• Deeds in lieu of foreclosure: Transactions with deeds in lieu of foreclosure are subject to the ordinary withholding rules, except if one of the following occur: (1) the buyer/transferee is the only person with a security interest in the property; (2) no cash or other property is paid to any person with respect to the transfer of the property; and (3) applicable notice requirements are met.

The Role of the Closing Agent

During a FIRPTA transaction, the buyer/transferee and foreign seller/transferor may instruct the closing agent to gather the applicable tax forms, deduct the withholding from the seller/transferor’s proceeds and remit the funds to the IRS on behalf of the buyer/transferee. The closing agent is generally not licensed or authorized to prepare any of the FIRPTA tax forms, provide advice regarding the FIRPTA withholding, or offer any legal advice.

With the high number of foreign investment in the U.S., it is crucial to understand FIRPTA requirements. This blog provides a basic overview of the FIRPTA requirements. For more information on FIRPTA, click here. Navigating the details can be challenging, so it’s imperative to consult with a tax professional and real estate attorney before closing on a property with a foreign seller.

Copyright ©2023 “2023 International Transactions in U.S. Residential Real Estate.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. August 1, 2023. https://cdn.nar.realtor//sites/default/files/documents/2023-international-transactions-in-us-residential-real-estate-08-01-2023.pdf

The information addressed herein is current as of November 21, 2023. Old Republic Title, its officers and employees do not provide, and this communication is not intended to be, investment, tax or legal advice. Old Republic Title makes no representations or warranties regarding the accuracy of the information or tax consequences addressed herein. You should consult an investment, tax or legal professional of your choosing to advise you of the benefits and risks of your specific transaction.